Theta Gang Strategies

If you’ve been studying options trading for a while now, you’ll probably agree that there’s something exciting about the potential to win life changing amounts of money, or lose it all. On top of that, the basics are relatively simple: Buy a call if you think a stock will go up, buy a put if you think it will go down. Basically it's gambling without having to go to a casino, and it closes at 4:00pm EST.

But does options trading always have to feel like gambling?

Here’s the thing: options trading can indeed be risky and to some extent, mind-boggling. But the truth is there are many strategies you can implement to minimize risk and ensure that you’re gaining in the long run.

One of my favorites? Theta gang strategies.

If you’re an r/wallstreetbets regular, you’ve probably come across some of our fallen fellows who lost money from options trading over a long period of time.

This can make diving into the world of options awfully intimidating. However, it’s important to note that people who tend to lose money on options usually end up doing so because they focus on buying options instead of selling them, which is what we do with theta-based strategies.

What is theta gang?

In a nutshell, theta gang strategies are gameplans that capitalize on time decay. If you don’t know what time decay is, it’s basically the underlying principle that dictates that If all other variables are constant, an option will lose value as time draws closer to its maturity.

Just a quick refresher: theta is one of the four option Greeks, a collection of four measures that quantify an option’s risk parameters. The other Greeks are known as delta, gamma, and vega. Theta measures an option’s price decay as time passes, which is why theta gang is known for taking advantage of time decay.

/options-lrg-2-5bfc2b20c9e77c005143deb4.jpg)

Why should you use theta-based strategies?

The world of options trading can be an endless pit of schemes and strategies, with each gameplan promising its own set of pros and cons. Theta-based strategies are known for having a rather limited return potential when compared to more in-your-face plays.

If that’s the case, then why should you even give theta-based strategies a second thought?

Well, two things: Simplicity and reduced risk.

Instead of racking your brains trying to predict if a stock will go up or down, theta gang advocates for simply playing the time game. It’s all about collecting profits from premiums by focusing on selling options. Then rinse and repeat to scale.

Again, people who use theta strategies use time as leverage and chiefly rely on premiums paid to earn money. They also enjoy the added benefit of having peace of mind. If you incorporate theta strategies correctly, you shouldn't have a ton of stress.

But how exactly do theta strategies work? And how can you use these theta strategies to make consistent returns? Let’s dive a little deeper.

Implementing theta gang strategies

In this section, we’re going to look at some of the most well-known theta gang strategies. Hopefully, this gives you an insight into how theta gang strategies operate and how they work to minimize risk and earn you consistent returns.

Bull Put Spread & Bear Call Spread

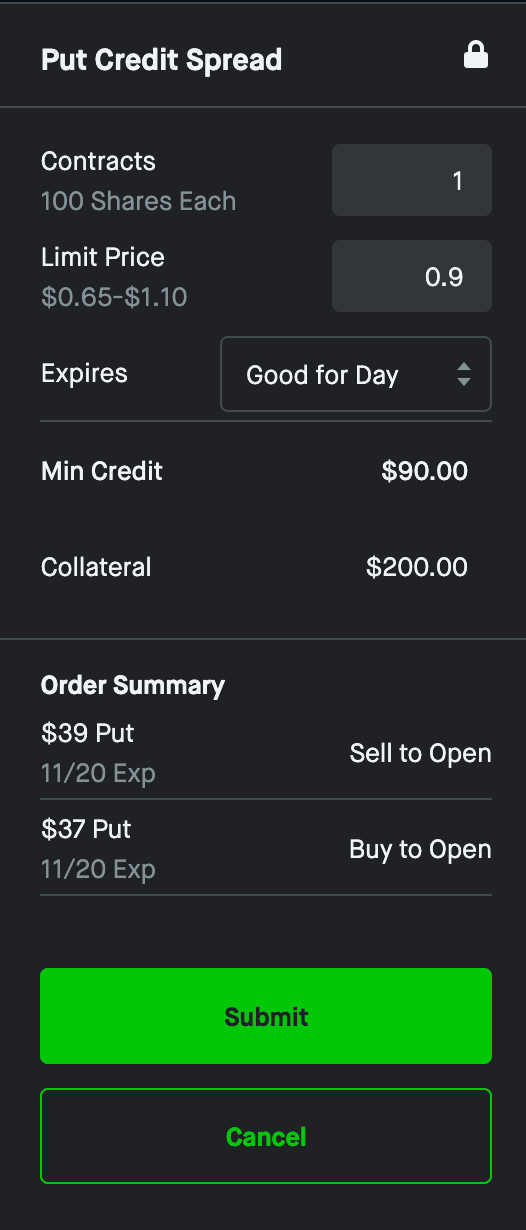

The Bull Put Spread and the Bear Call Spread are two of the simplest theta-based options strategies. They’re also known as Put Credit Spread and Call Credit Spread, respectively.

Credit spreads are done if you want to sell options with added protection from losses. Doing these strategies is simple. All you have to do is:

Step 1: Sell a naked option.

Step 2: Buy a cheaper one.

So if you want to set up a put credit spread, you start by selling a naked put. And then you buy a cheaper put to limit your potential downside. The same goes for call credit spreads: sell a naked call, then buy a cheaper call.

Your maximum profit in a put credit spread is the difference between the premium you received for selling the option and the premium you paid for buying the cheaper one. Sure, the potential maximum returns may not be as mind-blowing as other riskier strategies, but you do get the benefit of reduced risk. The same can be said for call credit spreads.

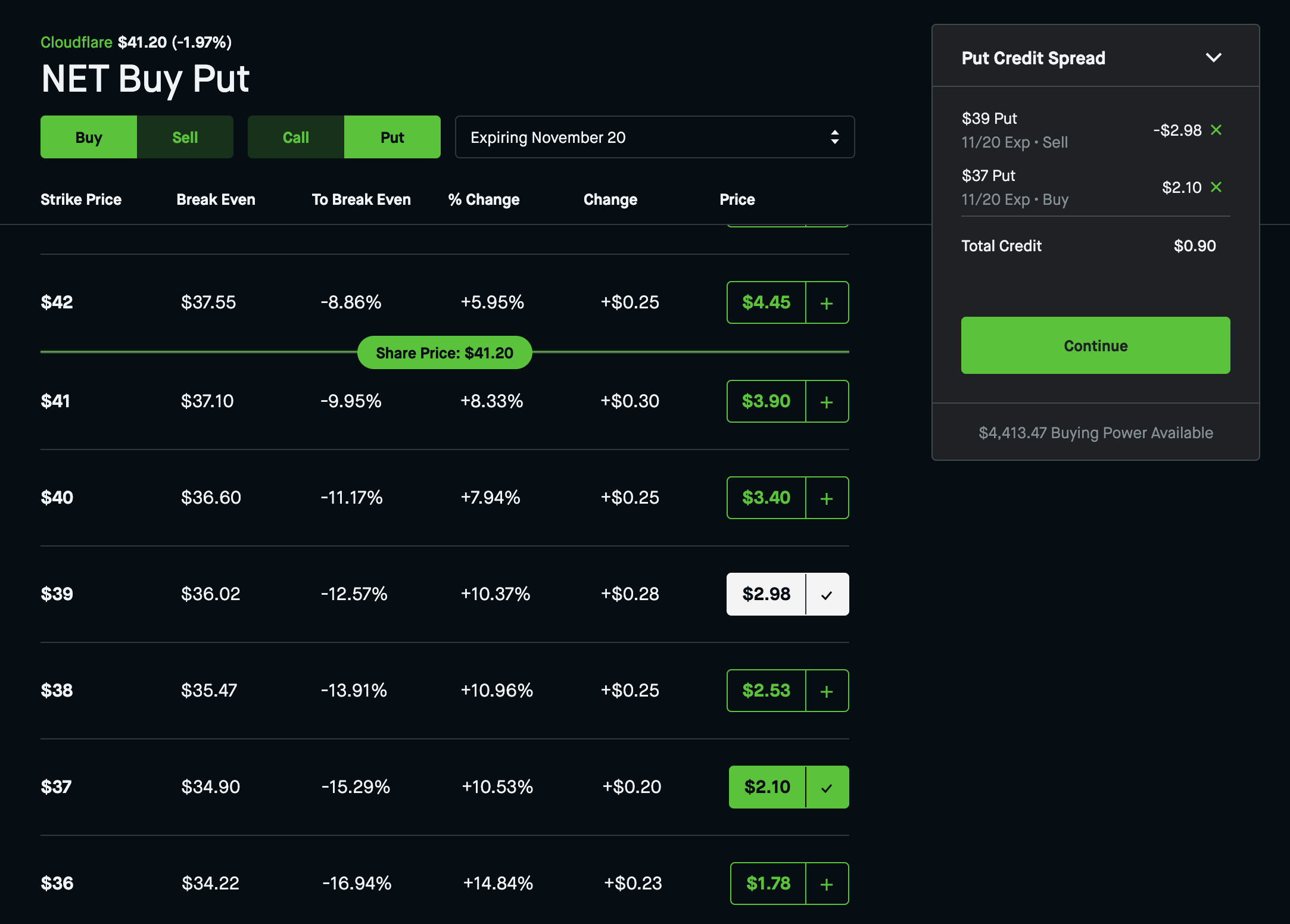

A real example

Net is currently trading for $41.20. I want to be able to collect premium from selling a $39 put, however, I'm not willing to buy this stock if it's below $37.

This makes my maximum loss here $200 if the price of Net goes below $37 on November 20th. (The difference between $39 and $37, multiplied by 100 shares)

$39 - $37 = $2.

$2 X 100 = $200.

How is $200 my max loss here?

I get my $90 premium if the stock closes above $39 on 11/20, and if it doesn't, the most I can lose is the $200 collateral I put down.

This differs from just selling a naked put, because in that circumstance, instead of putting down $200 collateral, I would put down $3900 in collateral, with the risk of being assigned to buy shares for less than they are currently worth. If the stock goes to $0 then I would lose my full collateral. If it stays above that $39 price point then I collect the full $298 in premium.

The Wheel Strategy

“The Wheel” is one of the most popular theta gang strategies out there, and it’s easy to see why.

It leverages covered calls and cash covered puts to build a regular income stream.

First, you sell an OTM cash covered put and keep the premium. Two things can happen from this point.

If the put expires worthless, then great! You get to keep the premium as your profit. You can rinse and repeat or scale to keep on collecting more premiums.

If the put gets assigned, then obviously, you’ll be forced to buy the shares at the designated strike price. When you get to this stage, you sell covered calls.

Selling covered calls will enable you to collect more premium. If the covered call expires worthless, then you can keep your shares and repeat the covered call -- collecting even more premium in the process. You do this until the call eventually gets assigned, at which point you’re getting your money back, primed and ready for another round of the wheel.

The exception here is if you really want to hold the shares that got assigned to you. If that’s the case, then skip selling the covered call. Simply spin the wheel anew.

Essentially, the point of the wheel strategy is to maintain a steady stream of income through the premiums being paid to you.

A real example:

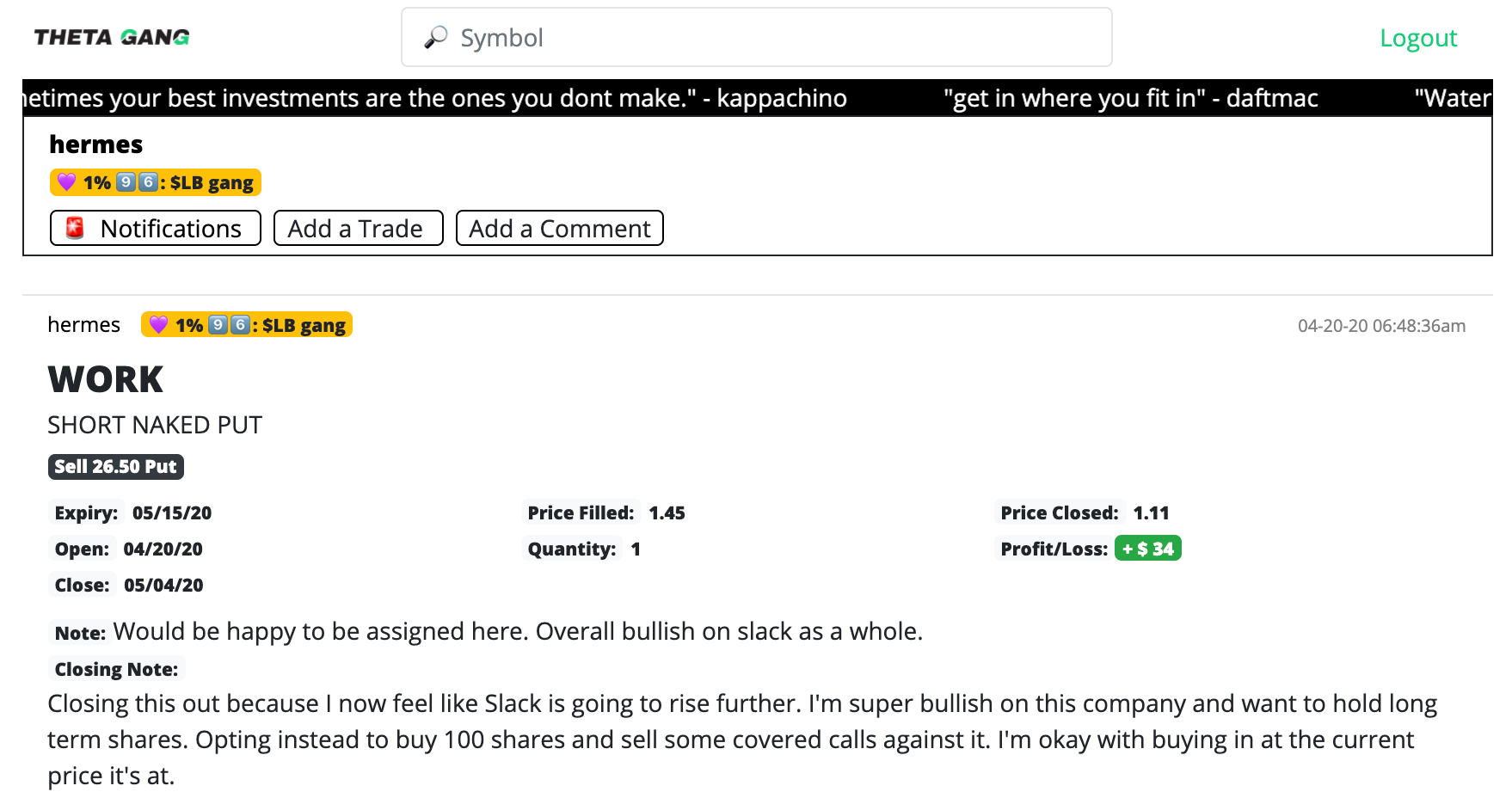

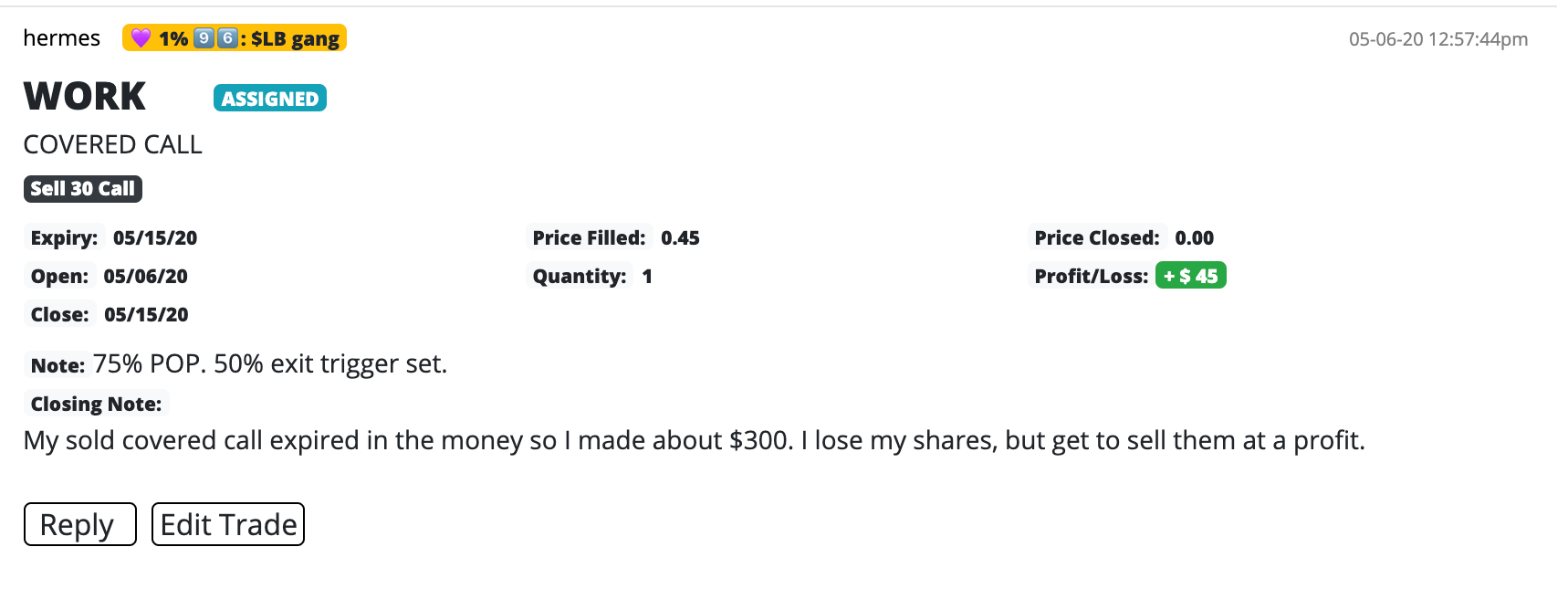

(I use thetagang.com to keep track all of my trades publicly)

April 20th, when I bought this option, $WORK was trading at $29.50. I wanted to own 100 shares of it but not for that price since I thought there would be resistance around the $30 mark.

I opted to sell a PUT for $26.50, and I collected $145 in premium up front for doing so.

In this circumstance I closed the option out about two weeks later because I felt bullish and didn't want to wait to be assigned.

I then started selling covered calls on $WORK.

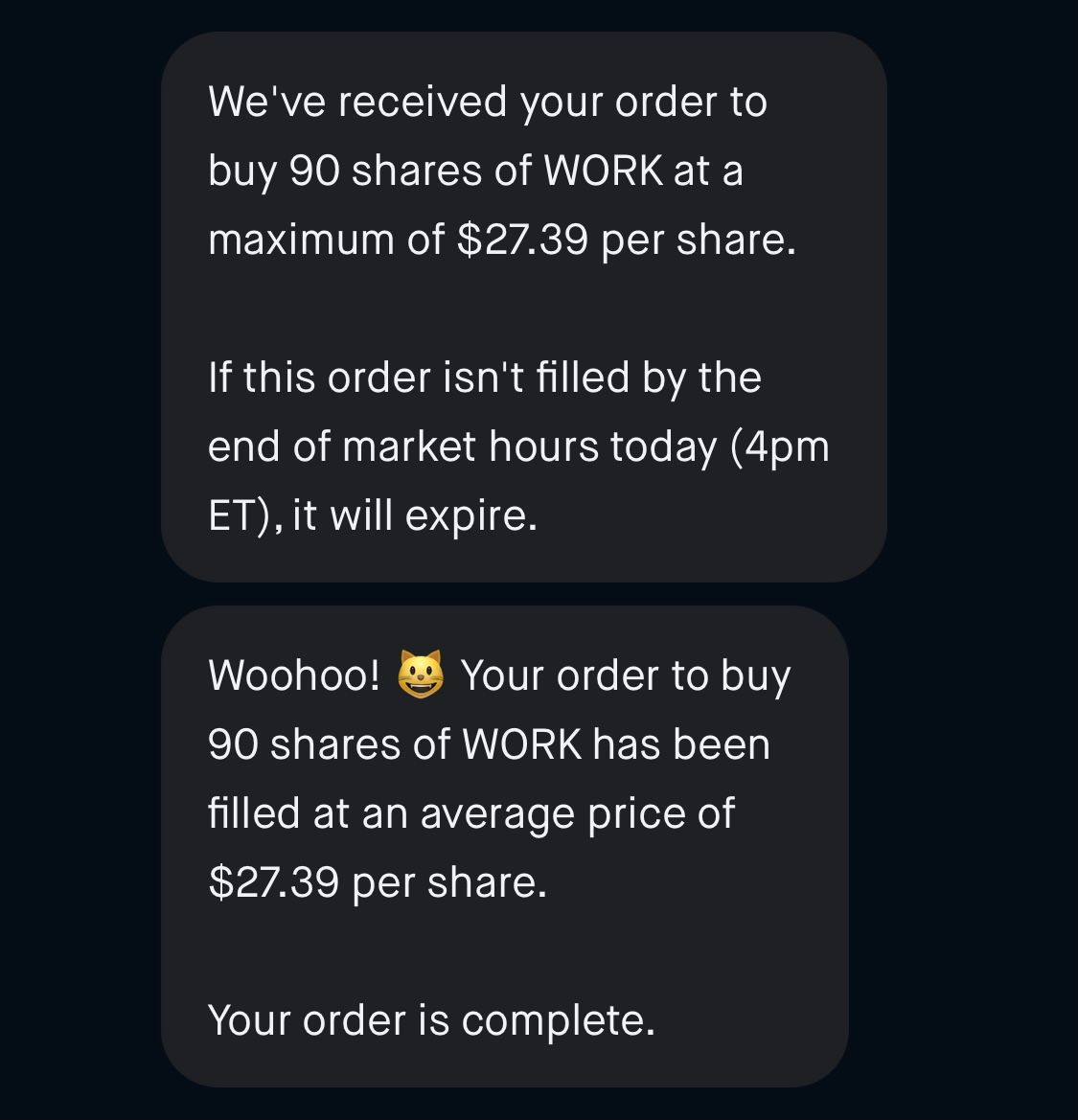

I owned 10 shares of $WORK already. I decided to buy the other 90 shares required to sell a call for $27.39.

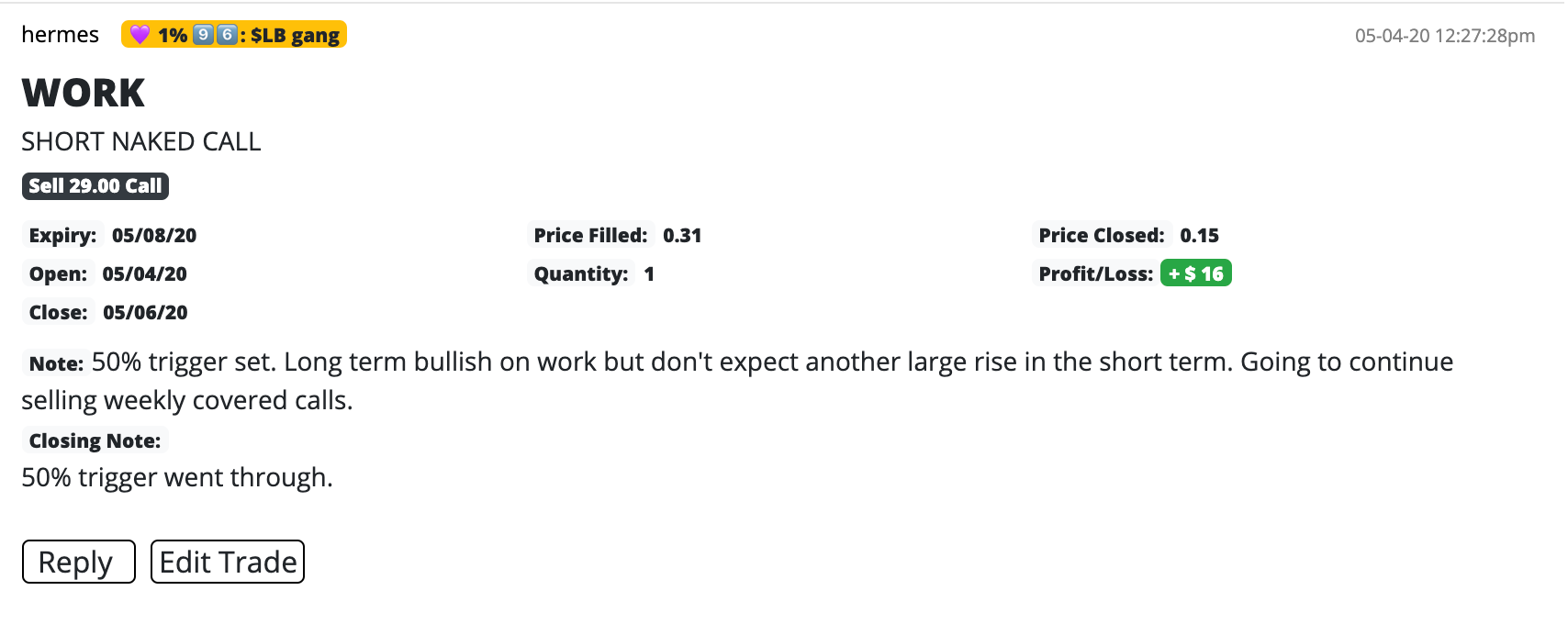

I then sold a $29 call with a buy order for 50% of the premium.

That 50% buy order eventually went through two days later.

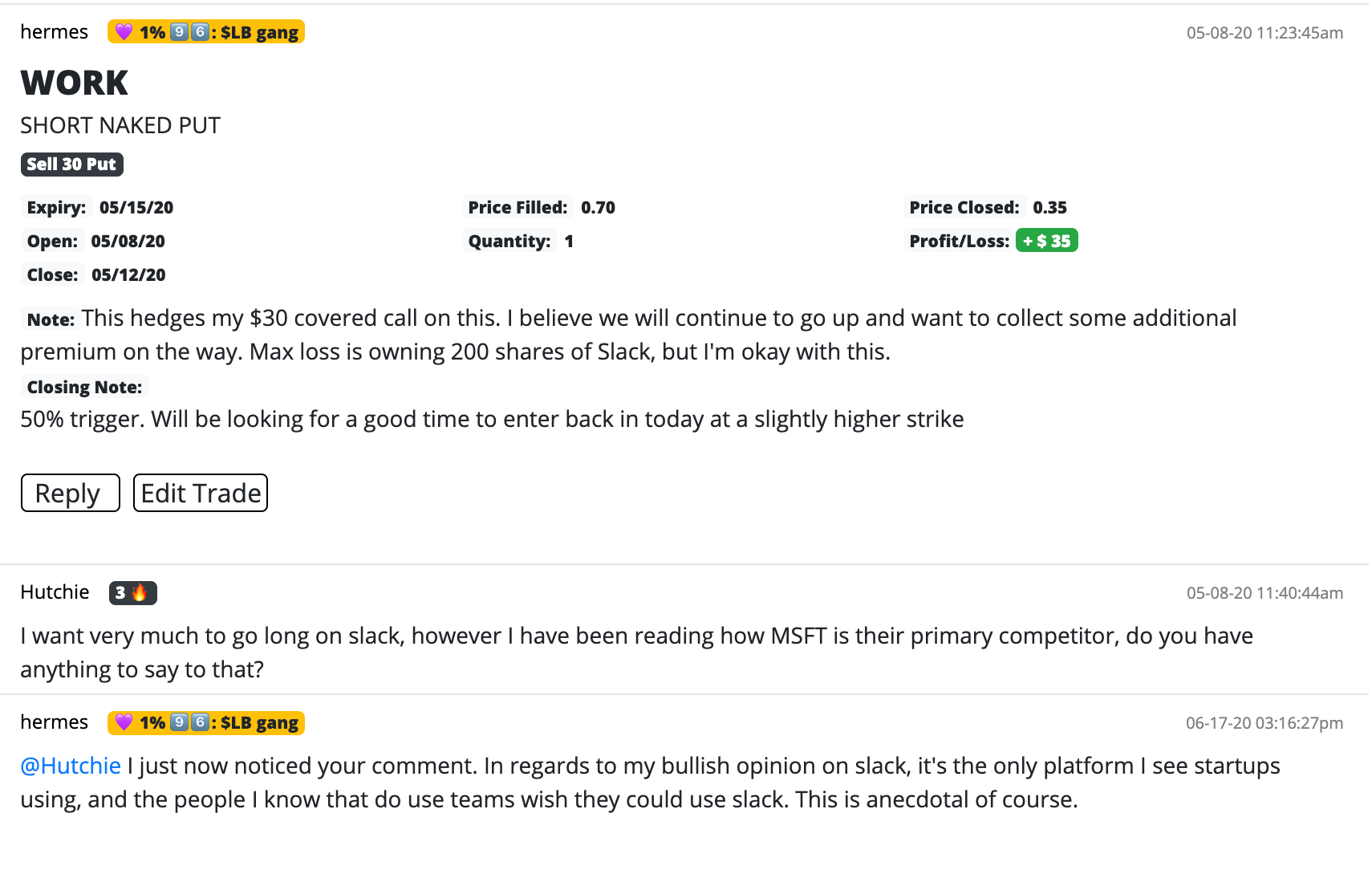

So I sold another Cash Covered Put, this time for $30, 1 week out.

Because I bought Slack at about $27, I made money on $WORK until it hit $30, so I came on top with a profit of about $300.

While I was waiting for that contract to expire I actually opted to sell another naked put for the same price just to collect some extra premium on $WORK.

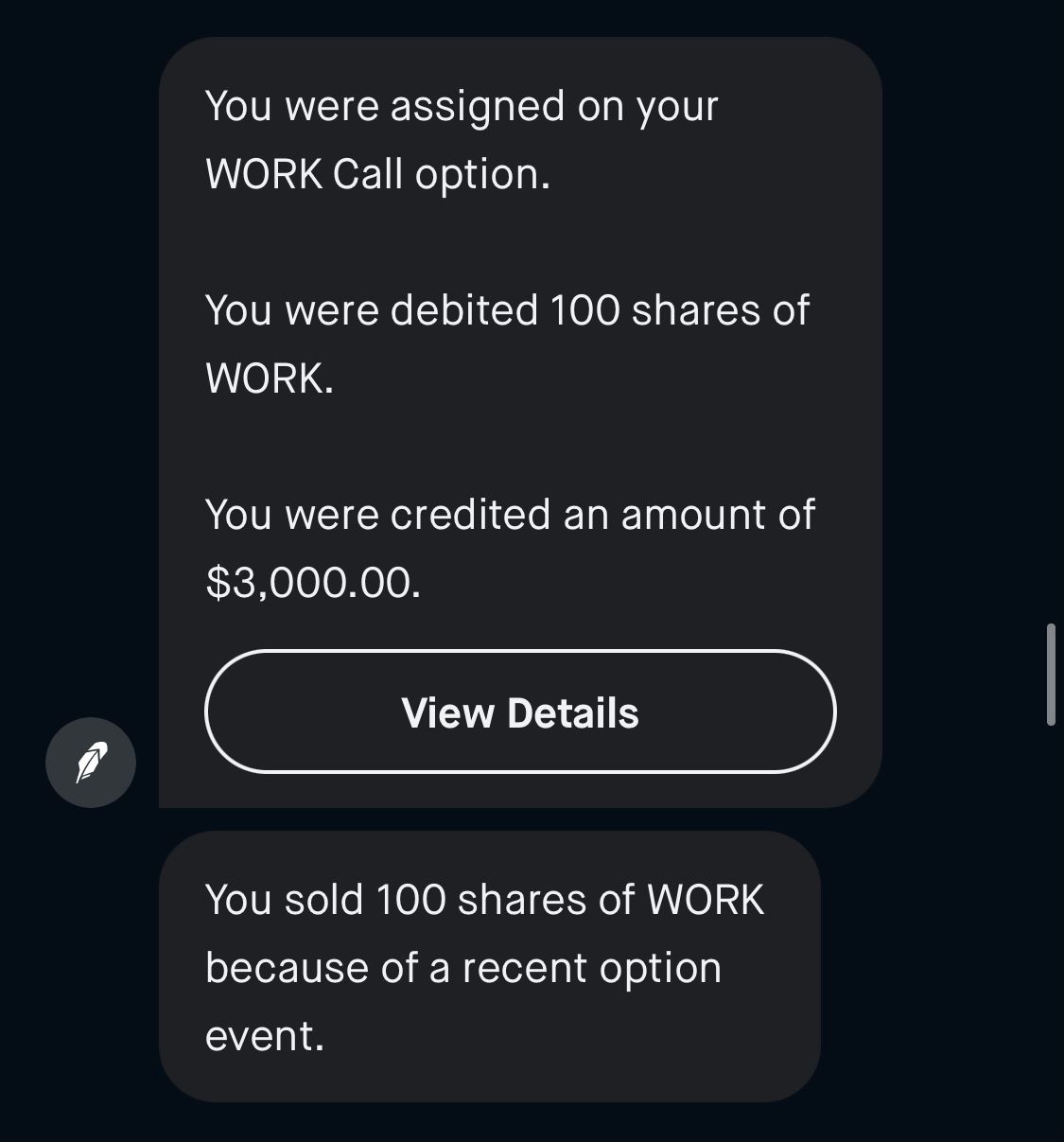

This is what it looked like when my call got assigned.

I was credited $3000 because I sold 100 shares of $WORK at $30 per share.

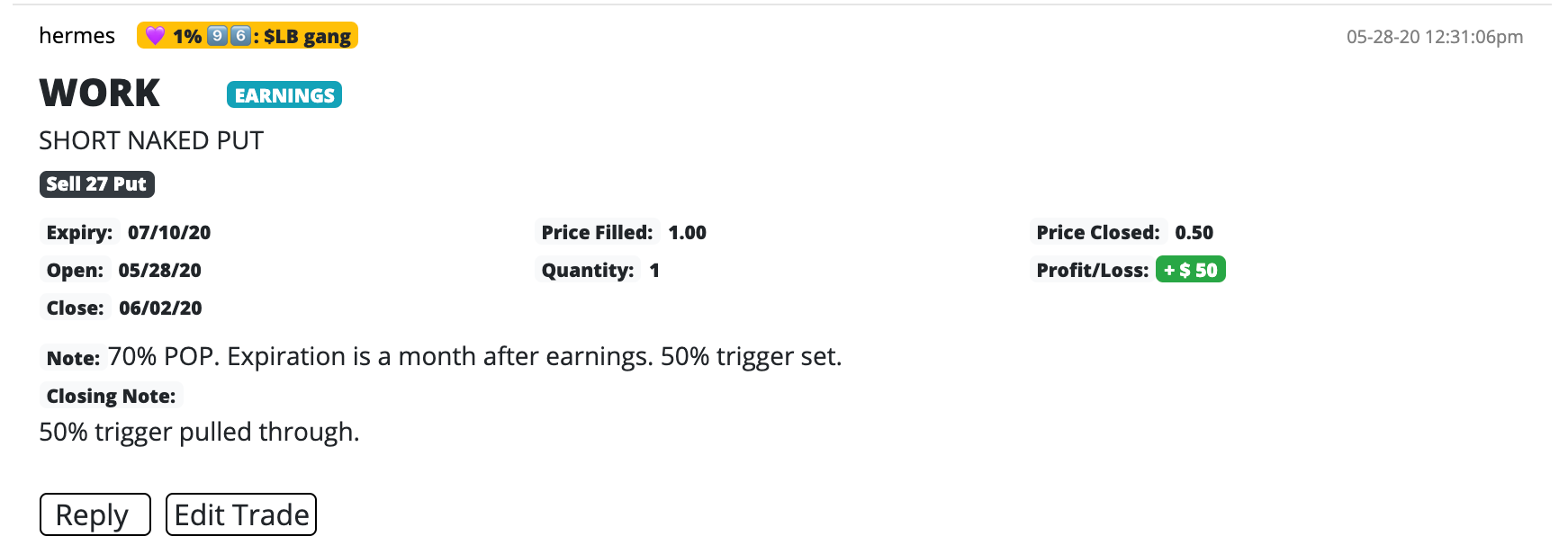

Then I continued to spin the wheel by selling puts on work.

All of this information is publicly available and timestamped on my ThetaGang profile:

https://www.thetagang.com/hermes

Trading with a plan

These strategies all sound really good on paper. But how do you make sure that these theories will translate to reality?

The answer is rather simple, but it can also be difficult to implement: trading with a solid plan.

Having a plan set in place will greatly reduce anxiety when trading options. For instance, I have a rule that for every option I sell, I immediately place a buy to close order for 50% of the premium. On my thetagang profile, if you look at my opening notes, you'll usually see that I write that I've set a 50% trigger. This is what is meant by that.

Because of this buy to close order, I’ll sometimes go several days without even checking to see what’s happening with the stock. I know that if the 50% of premium is received, my order will automatically trigger. For me this is what makes these strategies so enticing. I can work a full-time job and spend a minimal amount of time managing my portfolio, while maintaining that love of active portfolio management.

The more that you have a specific set of personal rules and protocols to follow, the more you ensure that your trading strategies are mechanical and based on actual figures rather than emotions.

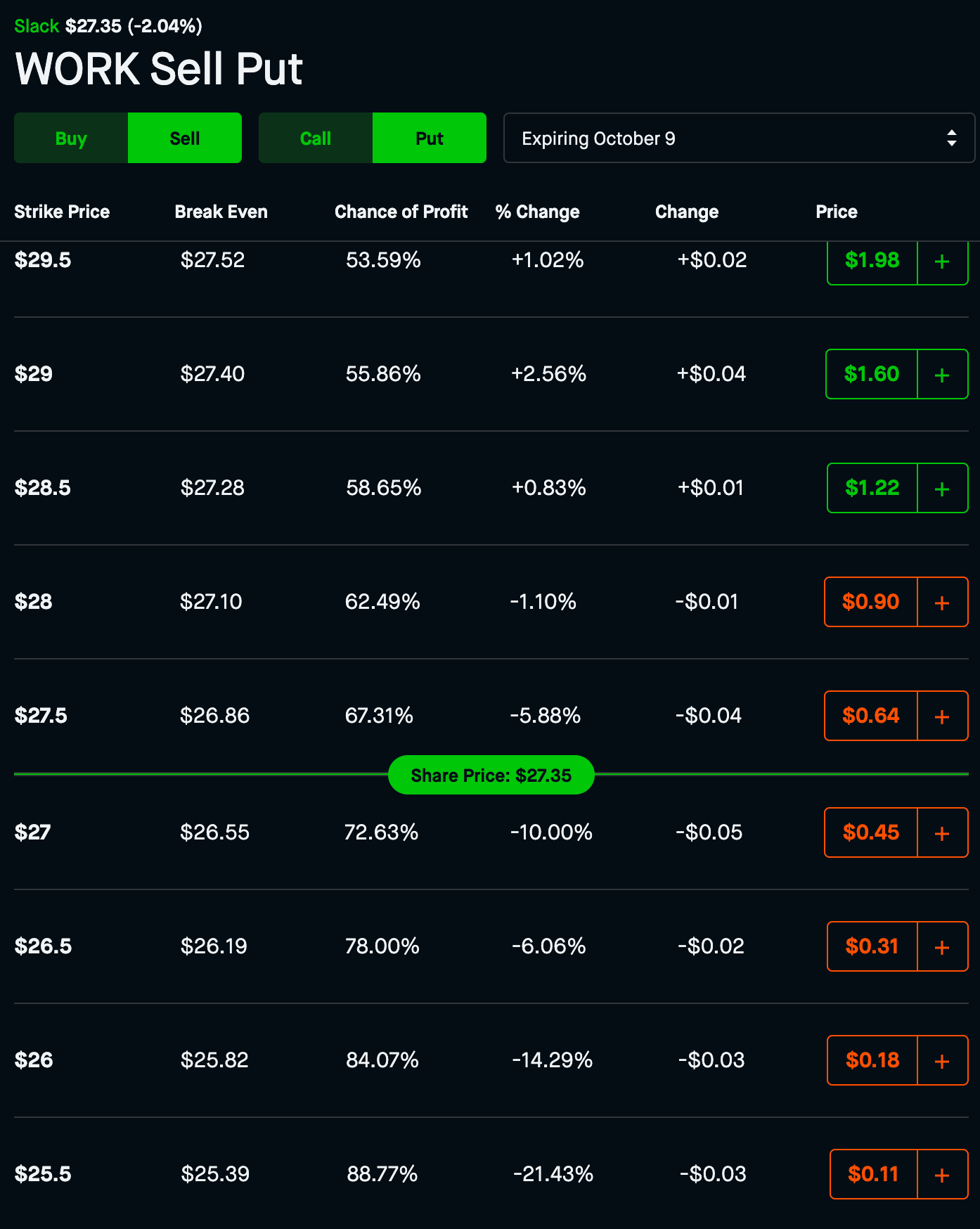

One such figure you can incorporate into your trading plan is POP or probability of profit. POP is defined as the chance of making at least $0.01 on a trade. You’ll usually find this number automatically calculated for you in your trading app.

Here's what POP looks like on Robinhood. If you check the chance of profit column there are percentages listed. When selling a PUT, The further an option is out of the money, the more your POP goes down. The more it's in the money, the more your POP goes up.

If you check my profile I usually go for between 70-80% POP unless I'm aggressively trying to get assigned.

Taking full advantage of actual probabilities vastly helps in creating long-term growth and cultivating a high win percentage.

How to make sure you’re winning in the long run

Although theta strategies are already pretty controlled in terms of risk, there are certain principles you can apply to help secure long-term wins for yourself:

Takeaway #1: Never sell puts on companies you wouldn't want to own 100 shares of, at a price you're happy paying for.

Having short puts expire worthless so you can fully enjoy the premium you received is great. But when you’re selling puts, it’s best to anticipate assignment. This way, you won’t lose sleep over the fear of buying shares at a loss.

That being said, make sure that you’re okay with holding the shares when you do get assigned. Only sell puts on companies that you’re happy to hold, at a price you don’t mind paying for.

Takeaway #2: Always sell calls at prices that you're happy to sell at.

Similar to takeaway #1, try to sell calls only at prices that you’re happy to sell at. Again, the point of this principle is to ensure that you’re not losing sleep over the fear of your shares getting assigned.

Takeaway #3: Learn how to manage your emotions.

Risky option plays can be a real rollercoaster ride. And although theta-based options strategies are designed to minimize downsides, getting caught up in emotions is still a possibility. Learning how to recognize and control emotional decisions will go a long way.

Log your trades publicly

If you’re curious about how more seasoned theta gang traders use these strategies, sites like Theta Gang can be a good resource. You can also use it to log your trades publicly as you’re learning and perfecting your strategy.

Personally, logging my own trades on https://thetagang.com/ has made me a more responsible trader. Sure, the thought of having every single one of my trades open to the public eye can be rather intimidating. However, the net effect of this practice has definitely been positive because it gives me accountability to not go into risky plays that I’m unsure of.

I understand how newbie option traders may initially opt to shy away from this practice. After all, it’s better to improve in private, and then log your trades publicly only when you’ve achieved a minimum level of competence, right?

Well, not really.

You could think of this as another application of the principle we’ve discussed above -- that is, being able to manage your emotions. Don’t let intimidation and the fear of making mistakes prevent you from maximizing your learnings. Publicly logging your trades is a great way to learn as much as possible, as quickly as possible.

Besides, Theta Gang isn’t just a gold mine of information, it’s an awesome community full of supportive people, too. I highly recommend that you check them out! The official ThetaGang Spotify podcast is also really helpful for beginners and seasoned traders alike.

I've been a Patreon member of the official ThetaGang community for several months now, and it's one of the most enjoyable and respectful online communities I've been involved with.

Conclusion

Properly implementing theta-based options strategies is a great way to make consistent returns without the usually high levels of stress associated with riskier option plays. It may take some practice, but the viability and practicality of theta gang options strategies aren’t difficult to see.